United States Tax Brackets 2025 - 2025 Tax Brackets IRS Makes Inflation Adjustments Modern Wealth, Your bracket depends on your taxable income and filing status. How much you pay in taxes is determined by which tax brackets you fall into. The 2025 federal tax brackets apply to your income in 2025, which you’ll report on the tax return that’s due in april 2025, or october 2025 with an extension.

2025 Tax Brackets IRS Makes Inflation Adjustments Modern Wealth, Your bracket depends on your taxable income and filing status.

IRS Tax Brackets 2025, Federal Tax Tables, Inflation Adjustment, As in 2025, the marginal tax rate(s) of 10%, 12%, 22%, 24%, 32%, 35%, and 37% will be in effect in 2025.

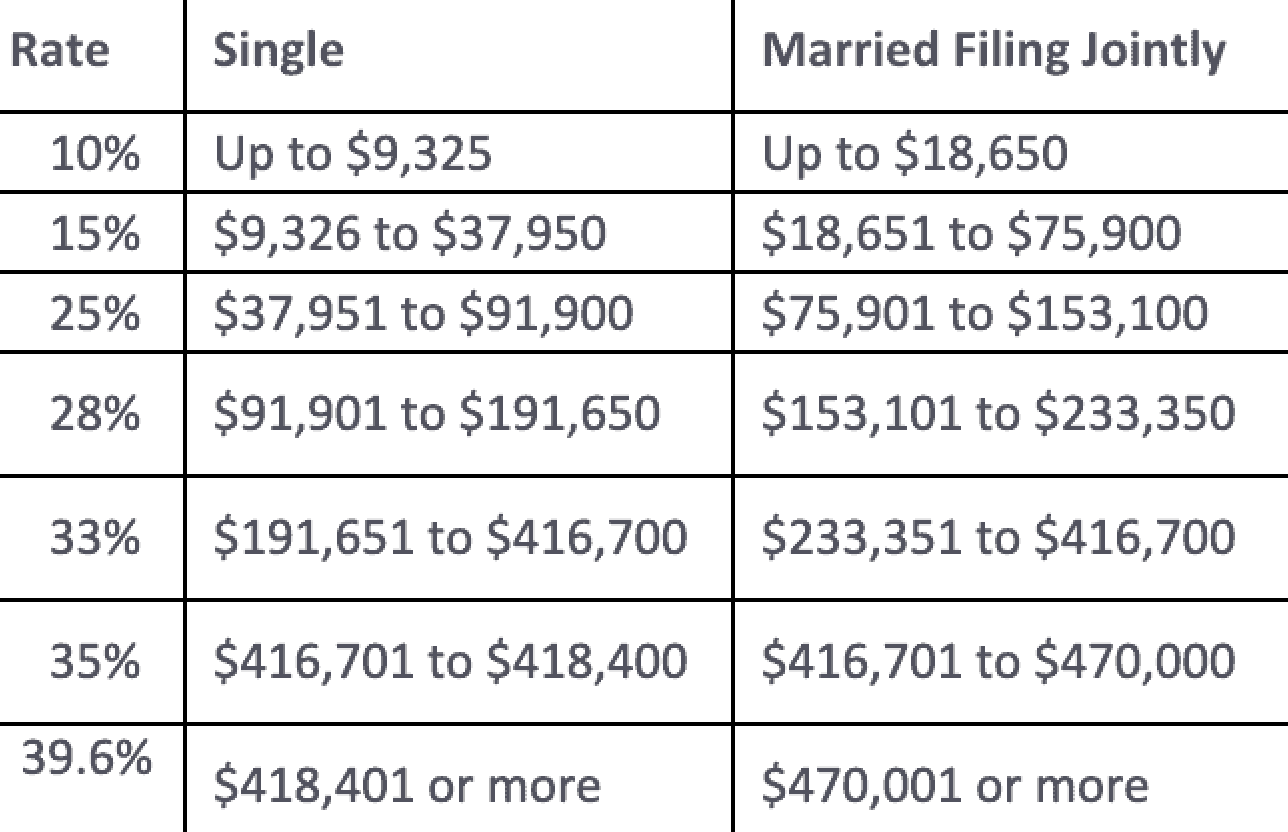

Tax Brackets 2025 Nerdwallet Schedule Dania Electra, The federal income tax has seven tax rates in 2025:

A Guide to the 2025 Federal Tax Brackets Priority Tax Relief, Individual, married, joint, head of household, widower tax tables with annual deductions, exemptions and tax credit amounts

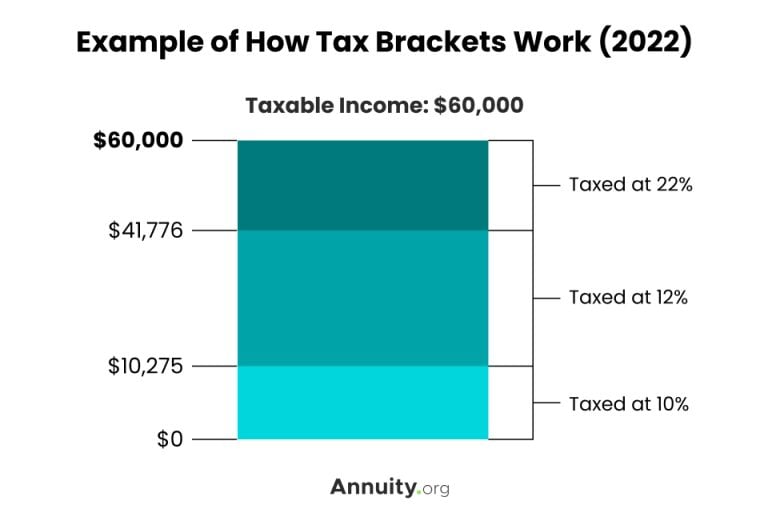

United States Tax Brackets 2025. The more you earn, the higher your tax rate becomes. See the 2025 tax tables.

2025 Tax Brackets Taxed Right, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets Aarp Members Etti Olivie, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).